The Single Strategy To Use For Eb5 Investment Immigration

The Single Strategy To Use For Eb5 Investment Immigration

Blog Article

The smart Trick of Eb5 Investment Immigration That Nobody is Discussing

Table of ContentsFacts About Eb5 Investment Immigration RevealedThe Ultimate Guide To Eb5 Investment ImmigrationGet This Report on Eb5 Investment ImmigrationThe 9-Second Trick For Eb5 Investment Immigration4 Simple Techniques For Eb5 Investment Immigration

While we aim to use accurate and up-to-date content, it ought to not be thought about lawful recommendations. Migration regulations and policies are subject to change, and specific situations can differ commonly. For personalized assistance and legal suggestions regarding your details immigration circumstance, we highly recommend consulting with a qualified migration lawyer who can provide you with tailored aid and guarantee conformity with existing regulations and laws.

Citizenship, through financial investment. Currently, since March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Areas and Rural Areas) and $1,050,000 somewhere else (non-TEA zones). Congress has authorized these quantities for the following five years beginning March 15, 2022.

To certify for the EB-5 Visa, Financiers need to create 10 full-time U.S. jobs within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Demand makes sure that financial investments add directly to the U.S. work market. This uses whether the work are developed directly by the company or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

The Of Eb5 Investment Immigration

These tasks are determined with designs that make use of inputs such as development costs (e.g., construction and equipment expenses) or annual earnings produced by continuous operations. On the other hand, under the standalone, or direct, EB-5 Program, only straight, permanent W-2 staff member placements within the company may be counted. A vital risk of depending entirely on direct workers is that team decreases because of market problems can lead to not enough permanent positions, possibly bring about USCIS denial of the investor's application if the job production requirement is not fulfilled.

The financial version after that projects the variety of direct jobs the new organization is most likely to create based upon its awaited earnings. Indirect jobs calculated with financial versions refers to employment generated in industries that provide the products or solutions to the business straight associated with the task. These jobs are produced as an outcome of the boosted demand for items, materials, or services that sustain business's procedures.

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

An employment-based fifth preference group (EB-5) investment visa offers a try this technique of ending up being a permanent united state resident for international nationals intending to invest capital in the USA. In order to obtain this permit, an international financier has to spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Location") and create or protect at the very least 10 permanent jobs for USA employees (excluding the financier and their prompt family).

Today, 95% of all EB-5 funding is elevated and spent by Regional Centers. In many regions, EB-5 investments have loaded the funding gap, supplying a brand-new, vital resource of capital for regional economic advancement tasks that rejuvenate areas, create and sustain work, infrastructure, and solutions.

Things about Eb5 Investment Immigration

workers. Furthermore, the Congressional Budget Plan Workplace (CBO) scored the program as profits neutral, with administrative costs spent for by candidate costs. EB5 Investment Immigration. More than 25 countries, consisting of Australia and the UK, use comparable programs to bring in international financial investments. The American program is extra rigid than several others, calling for substantial risk for financiers in regards to both their financial investment and migration condition.

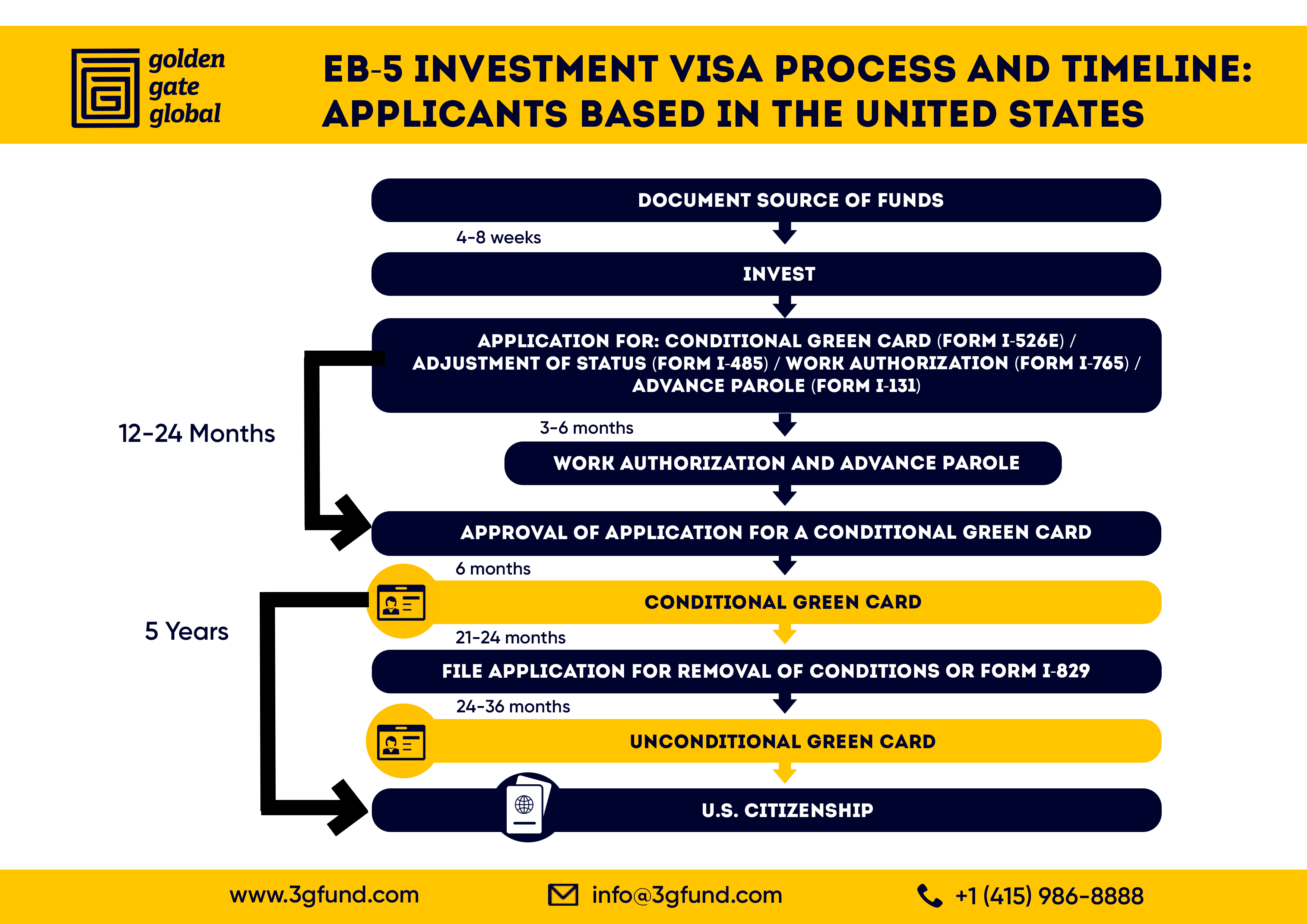

Families and people who look for to relocate to the United States on an irreversible basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) set out different needs to obtain irreversible residency through the EB-5 visa program.: The very first action is to find a qualifying financial investment chance.

When the possibility has actually been recognized, the financier must make the investment and submit an I-526 petition to the U.S. Citizenship and Migration Solutions (USCIS). This request has to include proof of the financial investment, such as financial institution statements, acquisition agreements, and business strategies. The USCIS will certainly assess the I-526 application and either accept it or request additional evidence.

The 6-Minute Rule for Eb5 Investment Immigration

The financier should obtain conditional residency by sending an I-485 application. This petition must be sent within 6 months of the I-526 authorization and need to include proof that the investment was made and that it discover this has actually created at least 10 full-time tasks for U.S. workers. The USCIS will evaluate the I-485 petition and either accept it or request extra proof.

Report this page